Tax Planning For Digital Nomads

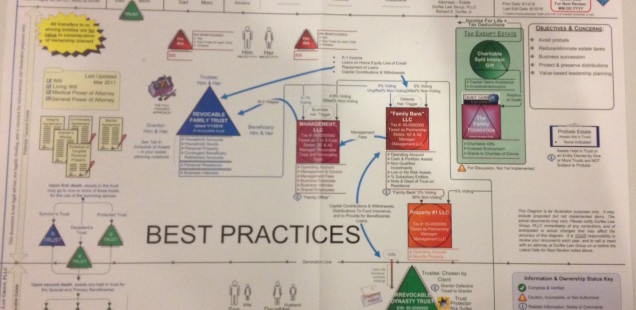

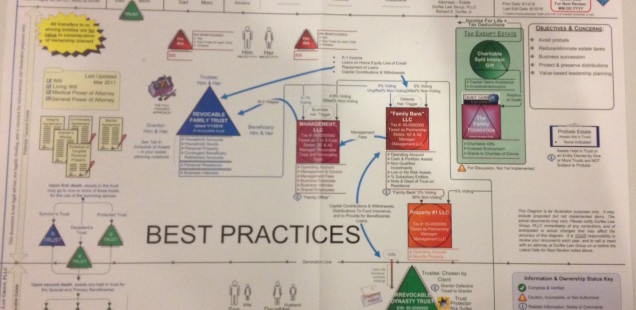

This is how billionaire families pay zero taxes.

The strategy involves many different entities. It involves a family ‘bank’, a family ‘foundation’, IRA’s, trusts, and more.

It’s complex. It takes months or years to implement.

After looking at this strategy I thought about my own small business. How much time have I spent planning for taxes?

I don’t have a plan like this, but if I did I might pay a lot less!

As a business owner, focusing on taxes is something you should think about even before you create your business entity!

Are there tax opportunities I’m not taking advantage of? Definitely.

What about your business?

Perhaps your strategy isn’t as complex as the graph above but a strategy is better than no strategy!

Tax planning is especially important as a digital nomad. You, your employees, and your business entity may all be in separate countries.

Don’t get caught in red tape. Don’t get stuck with fines and late fees. You’re not ‘safe’ just because you’re outside the USA. The IRS recently opened an office in the Philippines.

The benefits of a good tax strategy can be massive, and the financial nightmare brought on by a poor strategy are just as real. Start planning early.

Want to talk? Reach out to me via my contact form.